If you’re facing foreclosure, there are two things you can do:

1.) Request a loan modification and get a chance to save your home; or

2.) Request foreclosure alternatives like a short sale, deed-in lieu of foreclosure, cash for keys, lease back, deficiency relief, and others.

Talk to an attorney about your options!

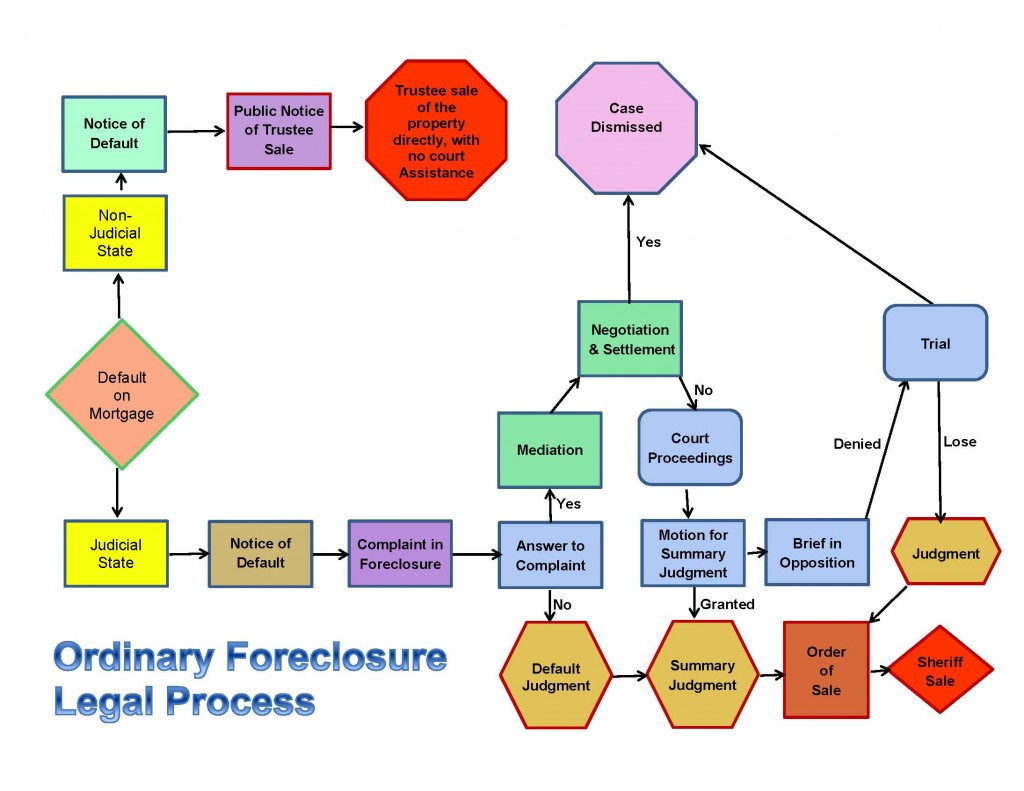

Foreclosures come in two types: judicial and non-judicial. Check the process in your state!

A judicial foreclosure is a process wherein your lender must go to court in order to seize your home. This makes foreclosure more expensive for your lender, and can typically take much longer to complete.

A non-judicial foreclosure, on the other hand, is based on the state’s statutory requirements. In this foreclosure process, lenders don’t have to go through the court system to foreclose on your home. This kind of foreclosure can take as little as two months. In California, the average time is four to five months.

In either case, once your lender decides to foreclose, they will record a Notice of Default (NOD) at the county office where your home is located. This usually doesn’t happen until you miss your third payment, but once it does, it progresses fairly quickly. Within 10 days, your lender will publish the NOD in the local newspaper and, within 30 days, you should receive the same notice by mail.

The NOD outlines the steps you need to take to resolve the defaulted mortgage. Most lenders give you three months to bring account current. Otherwise, your lender can schedule a sale date and your house can be sold within the next month. Once your home is sold, you have ten days to leave the property.

As you can see, time is of the essence when you’re facing foreclosure. This is especially true in states that have non-judicial foreclosure laws, such as California. You can see a more detailed description of the foreclosure process in the Foreclosure Timeline.

When a homeowner falls behind in their mortgage payments, they can expect lenders to react in specific ways at specific times. There are also two distinct foreclosure processes; judicial and non-judicial. While not all Lenders/Servicers use the same process, the following is a typical timeline from late payment to foreclosure:

Foreclosure Timeline

Day 1-15:

The Mortgage payment is due the first of the month and usually has a 15 day grace period until the 15th of the month.

When the borrower misses a payment:

Day 16-30:

A late charge is assessed, typically 5% of the monthly payment. The company that processes the payments (called the mortgage servicer) begins to attempt to make contact with the borrower to find out why the payment is late and begins collection activities. This is one of the the best times to request assistance, such as a loan modification.

Day 46-60:

The servicer sends a “demand” or “breach” letter to the borrower explaining that the terms of the mortgage have been violated. The borrower is given 30 days to resolve the delinquency by paying the delinquent amount. The “escalation” clause of the Standard Federal Mortgage is now in effect. The lender/servicer can only accept payment in full of all outstanding mortgage payments, penalties, collection costs, and other legally allowable fees, or forfeit their rights to foreclose on the property.

Day 120:

The latest time that a Complaint for Foreclosure will be filed in the court system. In a Judicial State, the homeowner must answer this civil suit, most often by using an attorney. The defendant then has 28 days to respond or have a default judgment issued by the court against them. (In California, after the recording of the Notice of Default, the borrower and junior lien holders are given proper notification and the borrower has 90 days to bring their account current. This period is referred to as the Reinstatement Period.

Day 201:

After 21 days of the recording of the NOS, a foreclosure sale can take place at public auction. (The property may be sold to a third party bidder or revert back to the lender for a specified amount.)

Trustee Sale (Sheriff Sale):

The property is scheduled for sale in as little as 60 days or as long as 300 days from filing. Bidders are required to pay with certified funds. The opening bid starts at two thirds, or 67%, of the sheriffs appraised value of the property. The auctioneer seeks the highest bid; the successful bidder must tender payment at the sale. In some states, there is a redemption period not longer than 30 days.

IMPORTANT, PLEASE READ: This timeline represents a typical foreclosure timeline for most mortgages. Each state has its own laws and foreclosure process. For a detailed breakdown of the foreclosure process in your state, consult a mortgage mitigation attorney licensed to practice law in your state.